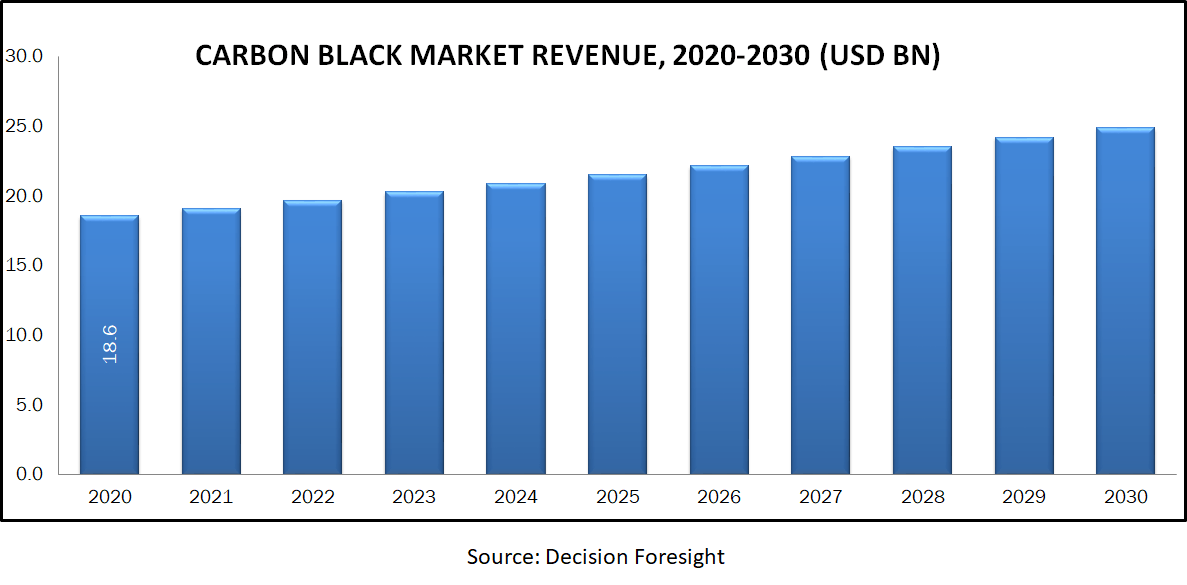

Carbon Black Market size was accounted at USD 18.6 billion in 2020 and is projected to reach 24.2 billion by 2029 growing with a CAGR of 3.0% from 2020 to 2029. Carbon black is formed either by partial combustion method or thermal decomposition which includes oil or natural gas as a feedstock. Carbon black typically comprises of more than 95 % pure carbon with minimal quantities of hydrogen, oxygen, and nitrogen. The market growth is mainly attributed to increasing usage of carbon black in widening application which include its use in plastics, paints & coatings, tire manufacturing, and further increased demand from various end-use industries such as aerospace and automotive. The most common use (70%) of carbon black is in automobile tires. Global demand for light commercial vehicle tires and cars is expected to have exceeded 1.6 billion units by 2018. The global demand for tires for cars and light commercial vehicles rose by 4.4 % in 2013. In 2015 the total market size for air-filled tires in the U.S. was roughly 40 billion USD dollars and is anticipated to grow to 60 billion USD dollars by 2022. Therefore, resulting in the increase in demand for the carbon black parallel boosting the market growth. Goodyear an American based tire manufacturer, is the third largest in the world, with 15 % of the global market in 2018. Growth in the adoption of electric cars and self-driving cars is expected to act as an opportunity in the future for the market growth.

Market Segmentation:

On the basis of type, the carbon black market can be classified into furnace black, channel black, thermal black, and acetylene black. Based on application, the market can be divided into tire, non-tire, paintings and coatings, inks, plastic, and others. By Geography the market is divided into North America, Europe, Asia-Pacific, and RoW.

Market Dynamics and Factors:

Due to increasing population and higher disposable income levels the automobile sales will continue to remain on higher side. Such trends along with supportive investments by private and and government organizations will boost the tire industry, thereby supporting the carbon black market in near future. Increasing global rubber production will positively affect the production of rubber goods. According to Malaysian Rubber Board, worldwide rubber production has increased by approximately 21% from 2010 to 2017. Observing such growth trends will boost the rubber goods industry in upcoming years, and this in turn will spur the growth of carbon black market. Large scale investments in construction industry is additional key factor contributing to the market growth all over the world. The positive outlook of construction industry will boost the paints and coatings market. The global coatings market observed growth by around 4% in 2017. These factors will generate significant revenue in the carbon black market during the forecast period. The market growth will be affected by carcinogenic content present in carbon black. It poses risk of respiratory discomfort and lung cancer due to high concentration exposures. The other factor hindering the market is replacement of carbon black with silica as a reinforcing agent in tire manufacturing. However, bolstering automotive aftermarket and construction sector in emerging economies is posturing as an important opportunity for further growth of the carbon black market.

Geographic Analysis:

The global carbon market has been dominated by Asia Pacific and will capture significant market share in revenue the growing tire and construction industry. Developing economies such as China and India are spending huge amounts of money for the development of residential, commercial and infrastructure buildings. China is the major consumer of carbon black in the world, with presence of more than 100 plants producing carbon black and with 35% of global consumption in 2016. Maximum of China’s carbon black production is for universal rubber materials and there is still a supply shortage for high-performance carbon black, low-rolling-resistance carbon black and conductive carbon black. China is the leading automobile-producing country in the world, which accounts for a huge amount of carbon black consumption each year (70% of consumption used in tires). Whereas, other Asian countries accounted for 21% of world consumption. During 2016–21, China and India will account for the major growths in new carbon black capacity. India is the chief producer of carbon black, followed by South Korea, Thailand, and Indonesia. Like other countries, maximum of Japan’s carbon black consumption is for tire production. Consumption in 2016 was around 70% of that in 2006, however it still accounts for 5% of global consumption. North America and Europe will observe stable growth due to growing production of rubber goods and tire. Growing demand for personal vehicles in this region will boost the tire and rubber goods as well as paints and coatings industry. Such trends will propel the demand of carbon black over the forecast period. North American carbon black consumption was accounted for 14% of global consumption in 2016. In 2016, over 75% of consumption was in industrial rubber products and nonrubber uses and remaining was in consumption was in the automotive industry tires and other rubber products. Consumption growth in North America will grow with 1.5–2% during 2016–21. Mexico will have the maximum growth in the region and lower growth is expected in Canada.

Competitive Scenario:

The key players in the global carbon black market are Evonik Industries AG, Nippon, Mitsubishi Motors Corp, Jiangxi Black Cat Carbon Co. Ltd, Philips Carbon Black, and China Synthetic Rubber Corp.

Carbon Black Market Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Billion (USD) |

| Growth Rate (CAGR%) | 3 % |

|

| By Type (Furnace Black, Channel Black, Thermal Black, and Acetylene Black), By Application (Tire, Non-Tire, Paintings and Coatings, Inks, Plastic, and Others), |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | Evonik Industries AG, Nippon, Mitsubishi Motors Corp, Jiangxi Black Cat Carbon Co. Ltd, Philips Carbon Black, and China Synthetic Rubber Corp. |

|

|

|