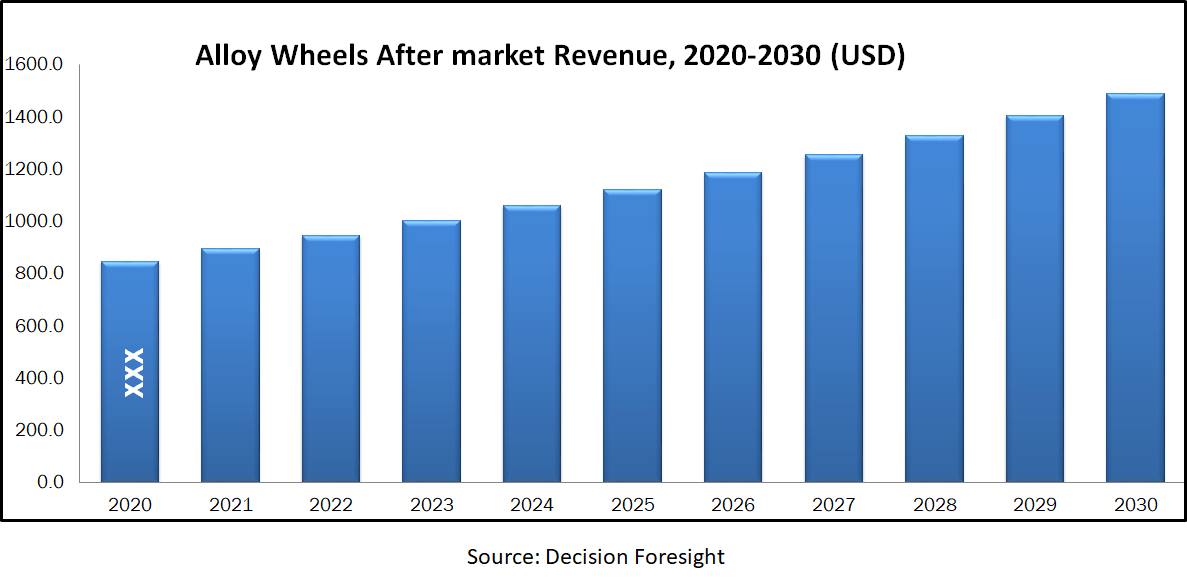

Alloy Wheels Aftermarket held USD XXX billion in 2020 and is to grow with a CAGR of XXX from 2020-2030. Automotive wheels are circular structures used to support the vehicle's axles, which are the structures on which the tires are mounted. They've significantly improved visual appeal as compared to the original spokes. Use of alloy wheels decreases the unsprung weight and assists in improvised vehicle handling. Alloy wheels are lightweight and provide the cars with quick acceleration, resulting in better mileage and fuel economy. Therefore, wheels made of steel in the automotive industry are slowly being replaced by alloy wheels. Alloy wheels are Aluminum and Magnesium alloy wheels. The increased use of alloy wheels in the automotive sector is attributed to many advantages of alloy wheels over traditional steel wheels.

Market Dynamics and Factors:

The increase in sales from online purchases is one of the latest alloy wheels aftermarket trends gaining momentum in the alloy wheels aftermarket industry. Specifically, the online distribution platform has given the aftermarket automotive parts and accessories a boost. Most of the exponential growth of this channel is driven by the rising digitalization of the purchasing process. Factors such as growing social media use, penetrating mobile technology and growing internet penetration serve as a catalyst for the growth of the online distribution channel, thereby positively affecting the overall alloy wheels aftermarket growth and an upcoming and dominating alloy wheels aftermarket trend. This rise in demand from vehicle bodies would also raise the alloy wheels aftermarket growth, as these products are the basis for the vehicle's operations.

Market Segmentation:

Based on the Rim Size, the alloy wheels aftermarket can be segmented into 13-15, 16-18, 19-21, >21 inch. Considering the material, the alloy wheels aftermarket can be classified into steel, alloy, carbon fiber. On the basis of off-highway the alloy wheels aftermarket is segmented into construction & mining, agriculture tractors. On the basis of vehicle type, the alloy wheels aftermarket is segmented into passenger vehicle, light commercial vehicle, heavy commercial vehicle. On the basis of vehicle class, the alloy wheels aftermarket can be bifurcated into economy, mid-priced, luxury-priced. Considering the end-use the global alloy wheel aftermarket can be divided into OE and aftermarket. Considering the geographic breakdown, aforesaid segments includes regions comprising North America, Europe, Asia-Pacific, and RoW.

Geographic Analysis:

Europe retained a significant alloy wheels aftermarket share in 2019, owing to the region's high vehicle production and increase in demand for luxury vehicles in rising economic countries. The availability of major component manufacturers and the presence of major OEMs in the area are key factors contributing to the considerable alloy wheels aftermarket share of the global automotive alloy wheels market held by Asia Pacific. In addition, strong demand for both passenger and commercial vehicles, attributed to an rise in vehicle penetration in Asia Pacific, is a prominent factor driving the region's automotive alloy wheels industry. Asia Pacific is seeing a resounding rise in passenger vehicle penetration. Automakers are gradually embracing alloy wheels to improve the esthetics of vehicles and attract buyers to increase car sales. In addition, China and Japan are the pioneers in vehicle performance enhancement research and development activities. To improve vehicle economy, vehicles need robust and lightweight vehicle components. This can be done by taking alloy wheels. All these factors accelerate the Asia Pacific demand for car alloy wheels, thus fuelling the growth in alloy wheels aftermarket industry.

Competitive Scenario:

The key players of global alloys wheel aftermarket industry BBS Alloy Wheels, ARCONIC, BORBET Gmb, Enkei CITIC Dicastal Wheel Manufacturing Co, Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd., MHT Luxury Wheels, Fuel Off-Road Wheels, RONAL GROUP MAXION Wheels, TSW Wheels, Superior Industries International, Inc., WHEELPROS LLC.

Alloy Wheels Aftermarket Report Scope

| Report Attribute | Details |

| Analysis Period | 2020–2030 |

| Base Year | 2021 |

| Forecast Period | 2022–2030 |

| Market Size Estimation | Million (USD) |

| Growth Rate (CAGR%) | XXX |

|

| Rim Size (13-15, 16-18, 19-21,>21 inch), Material (Steel, Alloy, Carbon Fiber), Off-highway (Construction & Mining, Agriculture Tractors), Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle), Vehicle Class (Economy, Mid-Priced, Luxury-Priced), End-Use (OE, Aftermarket) |

| Geographical Segmentation | North America (U.S., Canada, Mexico) Europe (UK, Germany, Italy, France, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of APAC), South America (Brazil, Argentina, Rest of SA), MEA (UAE, Saudi Arabia, South Africa) |

| Key Companies Profiled | BBS Alloy Wheels, ARCONIC, BORBET Gmb, Enkei CITIC Dicastal Wheel Manufacturing Co, Foshan Nanhai Zhongnan Aluminum Wheel Co., Ltd., MHT Luxury Wheels, Fuel Off-Road Wheels, RONAL GROUP MAXION Wheels, TSW Wheels, Superior Industries International, Inc., WHEELPROS LLC. |